Funding Traders Withdrawal

Exclusive Code 10%: «PROP10»

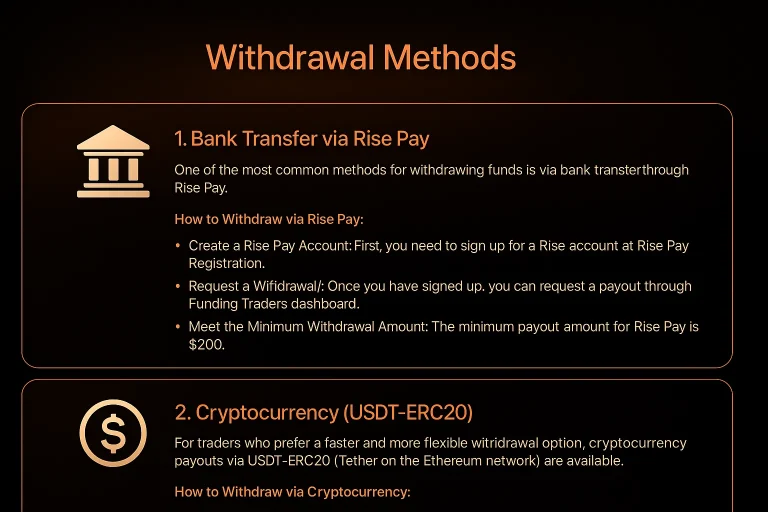

Withdrawal Methods

1. Bank Transfer via Rise Pay

One of the most common methods for withdrawing funds is via bank transfer through Rise Pay. Rise Pay is an online payment service that allows Funding Traders to facilitate payouts directly to traders’ bank accounts. To initiate a Funding Traders withdrawal via Rise Pay, traders must follow a few simple steps:

How to Withdraw via Rise Pay:

- Create a Rise Pay Account: First, you need to sign up for a Rise account at Rise Pay Registration.

- Request a Withdrawal: Once you have signed up, you can request a payout through the Funding Traders dashboard.

- Meet the Minimum Withdrawal Amount: The minimum payout amount for Rise Pay is $200.

This method is typically favored by traders who prefer bank transfers as it allows for smooth and secure transactions directly to their bank accounts.

2. Cryptocurrency (USDT-ERC20)

For traders who prefer a faster and more flexible withdrawal option, cryptocurrency payouts via USDT-ERC20 (Tether on the Ethereum network) are available. Cryptocurrency withdrawals are processed more quickly than traditional bank transfers, making them a popular choice for traders looking for faster access to their funds.

How to Withdraw via Cryptocurrency:

- Request Withdrawal: Place a withdrawal request on the Funding Traders dashboard.

- Provide Wallet Address: Enter your USDT-ERC20 wallet address to receive the funds.

- Minimum Withdrawal Amount: The minimum payout amount for cryptocurrency withdrawals is $50.

Cryptocurrency payouts offer a convenient option for traders who want to avoid delays associated with traditional banking systems, especially for international transactions.

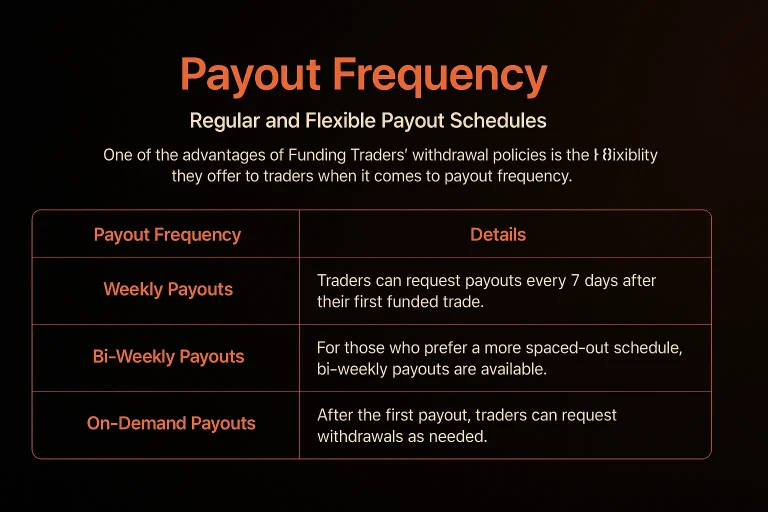

Payout Frequency

Regular and Flexible Payout Schedules

One of the advantages of Funding Traders withdrawal policies is the flexibility they offer to traders when it comes to payout frequency. Traders can choose between multiple payout schedules to best suit their needs.

Payout Frequency | Details |

Weekly Payouts | Traders can request payouts every 7 days after their first funded trade. |

Bi-Weekly Payouts | For those who prefer a more spaced-out schedule, bi-weekly payouts are available. |

On-Demand Payouts | After the first payout, traders can request withdrawals as needed. |

First Payout

The first payout, after completing the challenge and receiving a funded account, is processed after 7 days. This ensures that the trader has had enough time to establish themselves as a consistent performer.

Profit Sharing

Once a trader becomes funded, the withdrawal process is linked to a profit-sharing structure. Traders can receive a portion of the profits they generate, and the percentage varies based on how long they’ve been trading with the firm.

Payout Level | Profit Split |

First Payout | 70% |

Second Payout | 80% |

Third Payout | 90% |

Fourth Payout and Beyond | 100% |

This tiered profit split is designed to incentivize traders by increasing their profit share as they prove their consistency and reliability in trading.

Withdrawal Eligibility

To ensure the integrity of the withdrawal process, traders must meet specific eligibility criteria. These criteria help protect both the trader and the platform, ensuring that all payouts are legitimate and that funds are only withdrawn by eligible traders.

Key Eligibility Criteria:

- KYC Verification: Traders must complete the Know Your Customer (KYC) verification process before any withdrawal can be made.

- Account Balance: Traders must ensure that their account balance is above the starting amount to be eligible for withdrawals.

- No Open Positions: All positions must be closed at the time of the payout request.

- Consistency Score: Traders must maintain a consistency score of 25% or lower, meaning no single day’s profits should exceed 25% of the total profits made in the account.

These requirements help maintain the fairness and transparency of the withdrawal process while ensuring that funds are only accessed by traders who are meeting their performance expectations.

Withdrawal Processing Time

Once a withdrawal request is made, the time taken to process the payout varies based on the withdrawal method chosen. For cryptocurrency withdrawals, the process is typically quicker, taking around 28-48 hours. Bank transfers through Rise Pay may take slightly longer, depending on the bank and processing times.

It’s important to note that all withdrawal requests are processed during business hours, so delays can occur outside of these times. Traders should plan accordingly and make requests in advance if they need funds by a specific date.

FAQ:

The minimum payout amount for Rise Pay is $200.

Cryptocurrency payouts are typically processed within 28-48 business hours.

No, you must close all positions before requesting a payout.

After the third payout, traders receive a 90% profit split.

You can contact Funding Traders support at [email protected] for any questions or issues related to withdrawals.