Funding Traders Rules

Exclusive Code 10%: «PROP10»

Core Risk Rules That Apply to All Challenges

All challenges offered by Funding Traders are built around specific drawdown and loss limits. These limits apply across all phases—whether you’re in the evaluation stage or have progressed to a funded account. The parameters don’t change depending on your balance performance. They’re tied to your starting account size and remain fixed throughout the evaluation.

The most important risk-related Funding Traders Rules include:

- Maximum Loss (Overall Drawdown): Calculated as a percentage of the starting balance. Depending on the challenge, this ranges from 5% to 12%.

- Maximum Daily Loss: A hard limit applied per trading day, between 4% and 6%.

- Maximum Loss Per Trade: No single trade is allowed to risk more than 2% of the account.

- Minimum Trading Days: A trader must trade at least one day for the evaluation to be valid.

- No Exceptions: Breaching any of these limits results in an immediate failure of the account.

These rules are enforced through automated monitoring, and there is no reset or grace period for violations.

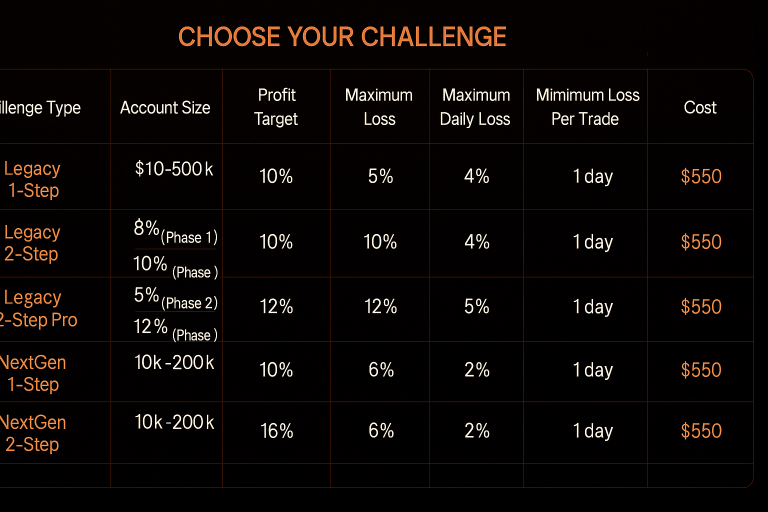

Challenge Conditions

Funding Traders offers five main challenge models. Each comes with different risk and profit parameters, while still operating under a unified rule structure. The table below presents an official summary of all the challenges offered by Funding Traders.| Challenge Type | Profit Target | Max Loss | Daily Loss | Max Loss/Trade | Min. Days |

| Legacy 1-Step | 10% | 5% | 4% | 2% | 1 day |

| Legacy 2-Step (Phase 1) | 10% | 10% | 5% | 2% | 1 day |

| Legacy 2-Step (Phase 2) | 5% | 10% | 5% | 2% | 1 day |

| Legacy 2-Step Pro (Phase 1) | 8% | 12% | 5% | 2% | 1 day |

| Legacy 2-Step Pro (Phase 2) | 5% | 12% | 5% | 2% | 1 day |

| NextGen 1-Step | 10% | 5% | 4% | 2% | 1 day |

| NextGen 2-Step (Phase 1) | 8% | 12% | 6% | 2% | 1 day |

| NextGen 2-Step (Phase 2) | 5% | 12% | 6% | 2% | 1 day |

Consistent Risk Enforcement Across All Models

Despite the variety of challenge types, Funding Traders applies the same enforcement logic to every account. Here’s how the core Funding Traders Rules work across programs:

Key Risk Rules for All Programs

- No trade can lose more than 2% of your starting balance

- Daily drawdown limits apply even during profitable trades

- Trailing or static max loss depends on challenge type

- One-day minimum trading requirement must be met

- Any violation results in immediate disqualification

Traders often forget that exceeding risk on a single position is just as serious as a total loss over time. Automated systems detect violations instantly, and accounts are not reviewed manually afterward.

Behavioral Rules and Trade Management

Funding Traders also sets expectations on trading behavior and strategy use. These aren’t just preferences—they’re enforced rules.

Strategy and Conduct Restrictions

- No copy-trading or signal mirroring

- No use of hedging, grid systems, or latency arbitrage

- No expert advisors that exploit tick manipulation

- News trading allowed in challenges but not in funded accounts

- Traders must not generate over 50% of their profit from one position

This last rule—profit concentration—is particularly strict. If one trade accounts for the majority of your profits, it may void the result. It forces consistent behavior rather than high-risk scalping or gambling tactics.

What Happens After You Pass?

Once you pass your challenge (1-Step or 2-Step), you move to a live funded account. All prior Funding Traders Rules still apply, but with added layers:

- Drawdown is calculated from your starting balance and does not reset

- Violations carry the same consequence: permanent account closure

- You may scale your account under the Funding Traders Scaling Plan if you meet conditions

- Funded accounts are not permitted to trade during high-impact news periods (this is different from evaluation accounts)

This transition phase is where many traders fail—not because of losses, but because they don’t adjust their behavior to the stricter environment of a live funded account.

Consistency Across the Brand

Even though Funding Traders offers different challenge names like Legacy, NextGen, and Pro, the foundation remains unchanged:

- Every rule is based on preserving account stability

- Every challenge enforces the same set of per-trade, daily, and total limits

- Evaluation doesn’t guarantee funding—compliance during scaling is still required

No matter which program you select, all risk parameters are enforced with the same severity. There are no exceptions for account size, trader background, or strategy type.

Conclusion

The Funding Traders Rules are structured to protect capital and enforce discipline. If you’re considering joining a challenge, here’s what you need to be ready for:

- Respect a strict 2% per-trade loss cap

- Don’t exceed 4%–6% daily loss (based on program)

- Stick to a minimum one-day evaluation even if you hit the target fast

- Never concentrate over 50% of profits in one position

- Avoid rule-restricted strategies and news trades (especially post-evaluation)

All rule violations are enforced automatically, without appeal. This makes the system predictable but unforgiving. If you want a chance to scale, you need to prove not just profitability, but strict compliance over time.

FAQ:

The drawdown structure is stricter in Legacy 1-Step, while NextGen allows slightly more room in two-phase formats.

Only if it doesn’t violate banned behavior like grid trading, latency arbitrage, or excessive trade frequency.

Yes, and in some cases, additional restrictions apply, especially around news trading.

No. All violations result in account termination without review.

Yes, but profits from news-based trades must not exceed 50% of total profit.