Funding Traders Challenge

Exclusive Code 10%: «PROP10»

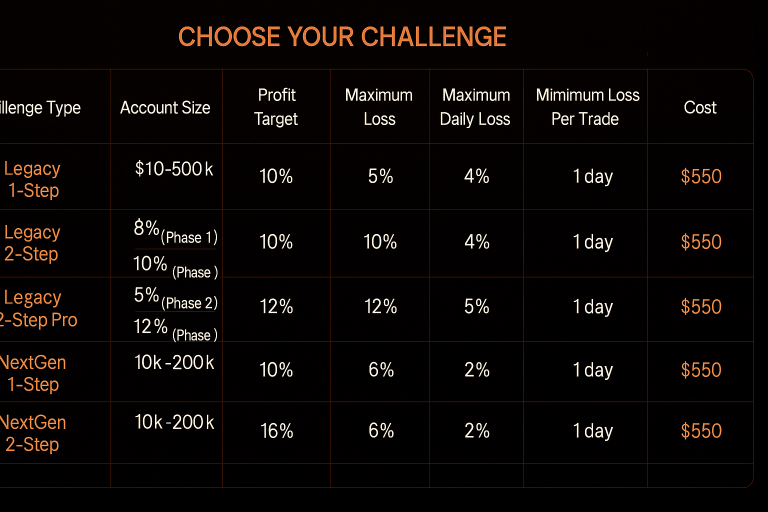

Choose Your Challenge

| Challenge Type | Account Size | Profit Target | Maximum Loss | Maximum Daily Loss | Maximum Loss Per Trade | Minimum Trading Days | Cost |

| Legacy 1-Step | $10k – $500k | 10% | 5% | 4% | 2% | 1 day | $550 |

| Legacy 2-Step | $10k – $500k | 10% (Phase 1) | 10% | 5% | 2% | 1 day | $550 |

| 5% (Phase 2) | 10% | 5% | 2% | ||||

| Legacy 2-Step Pro | $10k – $500k | 8% (Phase 1) | 12% | 5% | 2% | 1 day | $550 |

| 5% (Phase 2) | 12% | 5% | 2% | ||||

| NextGen 1-Step | $10k – $200k | 10% | 5% | 4% | 2% | 1 day | $550 |

| NextGen 2-Step | $10k – $200k | 8% (Phase 1) | 12% | 6% | 2% | 1 day | $550 |

| 5% (Phase 2) | 12% | 6% | 2% |

The Different Types of Funding Traders Challenges

Funding Traders offers a variety of challenge models, catering to traders with different risk appetites and trading styles. These challenges differ in terms of profit targets, drawdown limits, and the number of evaluation phases.

1-Step Legacy Challenge

The 1-Step Legacy Challenge is a single-phase evaluation where traders are required to meet specific profit targets and maintain strict risk management standards. The structure is simple and direct, making it ideal for traders who prefer a straightforward evaluation process.

Key Features of the 1-Step Legacy Challenge:

| Account Size | Profit Target | Maximum Loss | Maximum Daily Loss | Maximum Loss Per Trade | Minimum Trading Days | Cost |

| $10k – $500k | 10% | 5% | 4% | 2% | 1 day | $550 |

In the 1-Step Legacy Challenge, traders must achieve a 10% profit on their account balance while adhering to the 5% maximum loss and 4% daily loss limits. The challenge also has a restriction of 2% loss per trade, ensuring that risk is kept under control. Once these conditions are met, traders can access a funded account.

2-Step Legacy Challenge

The 2-Step Legacy Challenge consists of two phases. The first phase tests the trader’s ability to achieve a higher profit target with a greater risk tolerance. The second phase is designed to ensure the trader can maintain their profitability and risk management skills over time.

Key Features of the 2-Step Legacy Challenge:

| Account Size | Phase 1 Profit Target | Phase 1 Max Loss | Phase 1 Max Daily Loss | Phase 1 Max Loss Per Trade | Phase 2 Profit Target | Phase 2 Max Loss | Phase 2 Max Daily Loss | Phase 2 Max Loss Per Trade | Minimum Trading Days | Cost |

| $10k – $500k | 10% | 10% | 5% | 2% | 5% | 10% | 5% | 2% | 1 day | $550 |

In the Phase 1 of the 2-Step Legacy Challenge, traders need to achieve 10% profit while adhering to a 10% loss and 5% daily loss limit. Upon successfully completing Phase 1, traders proceed to Phase 2, where the profit target is reduced to 5%, but the drawdown limits remain the same.

2-Step Pro Legacy Challenge

For more experienced traders, the 2-Step Pro Legacy Challenge offers higher profit targets and larger drawdown limits. This model is suited for traders who are comfortable with taking on more risk for potentially higher rewards.

Key Features of the 2-Step Pro Legacy Challenge:

| Account Size | Phase 1 Profit Target | Phase 1 Max Loss | Phase 1 Max Daily Loss | Phase 1 Max Loss Per Trade | Phase 2 Profit Target | Phase 2 Max Loss | Phase 2 Max Daily Loss | Phase 2 Max Loss Per Trade | Minimum Trading Days | Cost |

| $10k – $500k | 8% | 12% | 5% | 2% | 5% | 12% | 5% | 2% | 1 day | $550 |

The 2-Step Pro Legacy Challenge has a more aggressive profit target and larger loss limits, making it ideal for traders who are willing to take on higher risk for potentially higher returns. Phase 1 requires an 8% profit, and Phase 2 requires 5% profit with the same drawdown limits as in Phase 1.

NextGen Challenges (1-Step & 2-Step)

The NextGen challenges are designed for traders who are looking for a more balanced approach to evaluation. The NextGen 1-Step and NextGen 2-Step challenges offer different profit targets and drawdown limits based on the trader’s risk tolerance and trading style.

Key Features of the NextGen 1-Step Challenge:

| Account Size | Profit Target | Maximum Loss | Maximum Daily Loss | Maximum Loss Per Trade | Minimum Trading Days | Cost |

| $10k – $200k | 10% | 5% | 4% | 2% | 1 day | $550 |

In the NextGen 1-Step Challenge, traders must achieve a 10% profit with a 5% maximum loss and a 4% daily loss limit. This challenge is simpler compared to the Legacy models and is designed for traders who prefer a more controlled evaluation process.

Key Features of the NextGen 2-Step Challenge:

| Account Size | Phase 1 Profit Target | Phase 1 Max Loss | Phase 1 Max Daily Loss | Phase 1 Max Loss Per Trade | Phase 2 Profit Target | Phase 2 Max Loss | Phase 2 Max Daily Loss | Phase 2 Max Loss Per Trade | Minimum Trading Days | Cost |

| $10k – $200k | 8% | 12% | 6% | 2% | 5% | 12% | 6% | 2% | 1 day | $550 |

In the NextGen 2-Step Challenge, Phase 1 requires an 8% profit with a 12% maximum loss, and Phase 2 requires a 5% profit with the same drawdown limits. This challenge is suitable for traders who want a more relaxed evaluation process with higher risk exposure.

How the Challenge on Funding Traders Works

The challenge operates as a structured evaluation process where traders need to achieve specific profit targets while staying within defined loss limits. The evaluation is divided into two phases (for most models), where Phase 1 assesses the trader’s ability to generate profits and manage risk, and Phase 2 evaluates the trader’s consistency and ability to sustain profitable performance.

Key Rules:

- Profit Target: Traders need to meet the specified profit target for the chosen challenge.

- Loss Limits: Traders must stay within the maximum loss and daily loss limits for each phase of the challenge.

- Risk Management: Proper risk management techniques, including using stop-loss orders and maintaining position sizes, are crucial.

- Trading Behavior: High-frequency trading (HFT), martingale strategies, and arbitrage trading are prohibited during the challenge.

- Consistency: Traders must demonstrate consistent performance without large fluctuations in equity.

Benefits of Passing the Challenge

- Access to a Funded Account: Upon completion, traders are given access to a funded account to trade with real capital.

- Profit Sharing: Traders can keep a significant portion of the profits generated from the funded account.

- Scalable Capital: Traders who perform well can scale their capital over time.

- Timely Payouts: After meeting the required conditions, traders can request payouts on their profits.

- Multiple Platforms: Traders can trade on platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

FAQ:

The duration depends on the trader’s performance. There is no fixed time limit, but traders must meet the profit targets while adhering to the loss limits.

If a trader exceeds the maximum loss or daily loss limits, they will fail the challenge and lose access to the evaluation account.

Yes, as long as the strategy adheres to the rules set out by Funding Traders, such as respecting the drawdown limits and avoiding prohibited practices like arbitrage.

To start, choose the account size and challenge model that best suits your trading goals, make the required payment, and begin trading on the selected platform.

Yes, there is an upfront fee required to participate in the challenge, which varies depending on the account size and challenge model.